Operational Update - Updated Credit Movement Reasons

Excited to announce that we’ve updated the list of credit movement reasons ready to go live for September 1st. These changes are designed to:

- Improve accuracy from a financial reporting perspective

- Consolidate duplicate or unclear reasons

- Remove outdated and unused reasons

It is important that the correct reason is selected every time you process a credit/ debit so please familiarise yourself with the revised list.

All the information is available for your reference here: Credit Movement Reasons Knowledge Article

Loom: Coming next week, in the meantime please reach out if you require any clarification on the new credit reasons.

🔑 KEY INFORMATION: Please Read

- Any credit corrections must be entered under the same reason as the initial entry.

- Example: You credit a customers account $2000 under the Stripe Invoice credit reason however you were only meant to credit $200. You would then debit $1800 under Stripe Invoice to ensure the amounts net off against one another.

- Adding credit to then process a Credit Reversal to Cash or a Manual Refund to Cash

- You must credit the amount to the customers account under Booking Refund then debit the amount under Credit Reversal to Cash or Manual Refund to Cash

- Credit refunds to cash which involve Credit Forfeits or Bonus Credits

- You must remove the Credit Forfeit or Bonus Credit first, then you can remove the remaining credit under the relevant refund reason.

- Example: A customer processed a refund of their $1000 booking. They chose credit refund instead of default and they received an additional 10%. The customer contacts us immediately to change their refund to default. You would debit the $100 from their account under Bonus Credit then debit the initial $1000 under Credit Reversal to Cash.

- Currency Conversions

- Conversion of currency should be processed under Transferring Credit

- Example: Customer has 500SGD in credit from a previous purchase, they're looking to purchase a package in AUD and require their SGD credits to be converted.

You would;

1. Debit the SGD500 under Transferring Credit

2. Change the currency to AUD (top right hand corner)

3. Credit the account to the equivalent AUD value under Transferring Credit

- Booking Refund: New Requirement

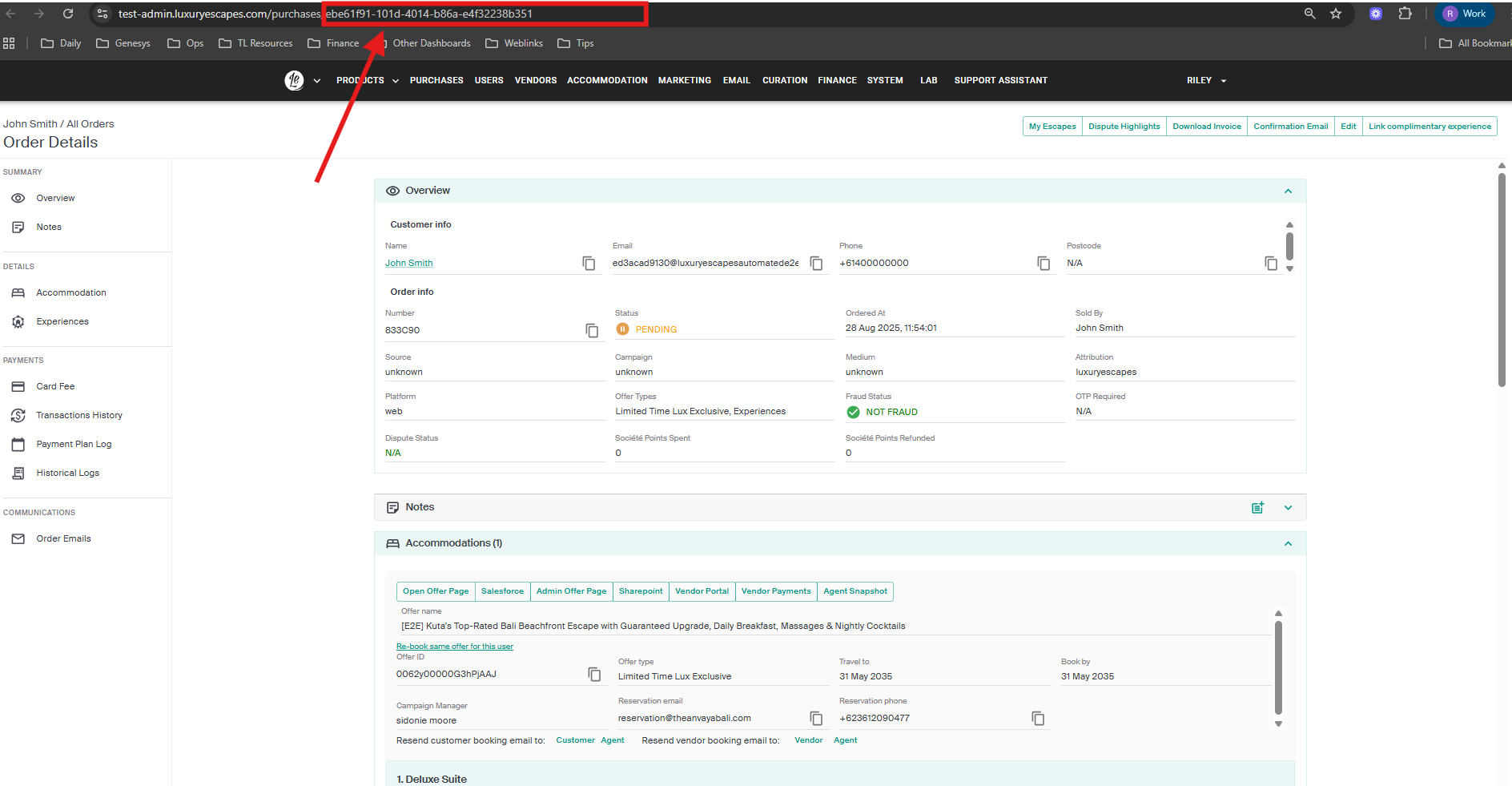

- If crediting the customers account under Booking Refund a required field will pop up on the credit page and you will be required to link the related order ID. (Found in the URL of the order page)

Credit Movement Reasons & Definitions

- (NEW) Bonus Credit: Removal/ addition of credit relating to the 10% bonus credit which customers receive if they chose credit instead of default refund

- (NEW) Booking Refund: Applying credit from bookings cancelled to offline manual or whereby the cancellation did not properly apply the credit to customer account

- Bulk Corporate Gift Card Purchase: Apply credit after Gift Card purchase

- Cancellation of Fraudulent Credit: Remove credits that were fraudulently attributed

- Chargeback: Add/ remove credits relating to a Chargeback

- (NEW) Credit Forfeit: Expired credit, removal following 80/20 refunds and any credit that is forfeited by the customer

- Credit Reversal to Cash: Remove credits prior to processing a credit reversal (reversing the funds of a transaction)

- Gift Card: Apply credit initiating from a gift card if there are gift card redemption issues

- (NEW) Goodwill Gesture: Used in lieu of a promo code or to cover marginal increase in booking cost

- LEBT Issued: Add/ remove credits relating to a LEBT

- Manual Bank Transfer to LE: Add credit following a manual bank transfer to LE

- Manual Refund to Cash: Removal of credit prior to processing a manual refund submission to customer bank account

- Marketing: Add/ remove credits relating to marketing expenses

- (NEW) Merchant fee/ Credit Card Fee: Removal of credit initiating from credit card/ merchant fee’s

- Offer package credits: Removal of credit relating to a package credit

- PayTo Credit: Apply credit via PayTo process

- People & Culture: Apply credit following P&C initiatives (incentives/ 5 star awards etc)

- (NEW) Purchase/ Deposit (spent): Removal of credit following offline/ custom/ cruise/ PNR purchase

- Reactivated Credit: Applying credit following a credit expiry

- Refund of Fraudulent Spend: Applying credit following a cancellation of a fraudulent booking made with credit

- Store Credit: Applying credit following an in-store transaction

- Stripe Invoice: Applying credit following customer payment via stripe invoice

- (NEW) Temporary Removal/ Addition: Removal of credit temporarily, adding credit back following temporary removal

- Transferring Credit: Add/ remove credit to transfer the value from one account to another

- (NEW) Test Credit: Add/remove credit in test environments – used by CMs, training

Please make sure you use the most accurate reason available going forward. This will help us maintain clean data and ensure financial reporting is accurate.

Thanks to everyone who helped out on this! Especially @Bing Liu, @Natalie Morwood, @Samuel Drown, @Rob Rossi, and @Chris Swanepoel.

If you have any questions, please reach out to your TL

📧 This was also communicated via email on 29th August 2025, titled "Updated Credit Movement Reasons" sent by Riley L (Customer Experience Operations Leader).

Please sign in to leave a comment.

Comments

0 comments